News: Markets

11 March 2021

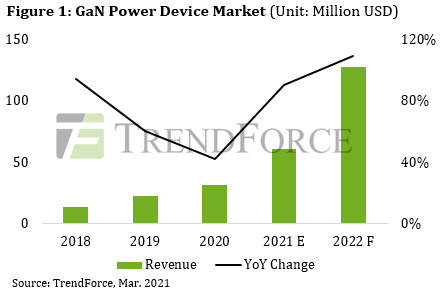

GaN power device market to grow 90.6% to $61m in 2021

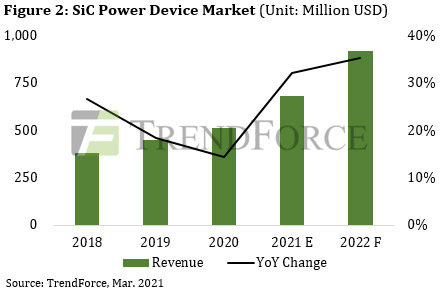

The silicon carbide (SiC) and gallium nitride (GaN) ‘third-generation’ semiconductor industry was impaired by the US-China trade war and the COVID-19 pandemic successively from 2018 to 2020, according to TrendForce’s latest investigations. During this period, the semiconductor industry on the whole saw limited upward momentum, in turn leading to muted growth for the third-generation semiconductor segment as well. However, due to high demand from automotive, industrial and telecom applications, this segment is likely to enter a rapid upturn. In particular, the GaN power device market will see the fastest growth, of 90.6% year-on-year to $61m in 2021.

TrendForce expects three factors to drive the rapid growth in the GaN and SiC markets in 2021: First, widespread vaccinations are projected to drastically curb the spread of the pandemic, galvanizing a stable increase in demand for base-station components, as well as for components used in industrial energy transition, such as power inverters and converters. Secondly, as Tesla began adopting SiC MOSFET designs for its in-house inverters used in Model 3 vehicles, the automotive industry has started to place increasing importance on third-generation semiconductors. Finally, China will invest enormous capital into its 14th five-year plan starting this year and expand its third-generation semiconductor production capacity to ultimately achieve semiconductor independence.

Resurgent demand from EV, industrial and telecom sectors

Although certain foundries, such as Taiwan Semiconductor Manufacturing Company (TSMC) and Vanguard International Semiconductor (VIS), have been attempting to manufacture GaN devices on 8-inch wafers, 6-inch wafers are still the mainstream. As the pandemic shows signs of a slowdown, the demand for RF front ends in 5G base stations, for smartphone chargers, and for automotive on-board chargers has now gradually risen. Total annual revenue from GaN RF devices is hence projected to grow by 30.8% to $680m in 2021 (compared with the 90.6% growth to $61m for GaN power devices).

In particular, the remarkable increase in GaN power device revenue can be attributed primarily to the launch of fast chargers from smartphone brands such as Xiaomi, OPPO and Vivo, starting in 2018. Thanks to their effective heat dissipation and small footprint, these chargers enjoyed excellent market reception. Some notebook computer manufacturers are currently looking to adopt fast-charging technology for their chargers as well. Going forward, TrendForce expects more smartphone and notebook chargers to feature GaN power devices, leading to a peak year-on-year increase in GaN power device revenue in 2022, after which there will be a noticeable slowdown in its upward trajectory as GaN power devices become widely adopted by charger manufacturers.

On the other hand, 6-inch wafer capacities for SiC devices have been in relatively short supply, since SiC substrates are widely used in RF front-end and power devices. TrendForce expects annual SiC power device revenue to grow by 32% to $680m in 2021. Major substrate suppliers, including Cree, II-VI and STMicroelectronics, are planning to manufacture 8-inch SiC substrates, but the short supply of SiC substrates is unlikely to be resolved until 2022.