News: Suppliers

29 April 2020

IQE’s annual revenue falls 10.4% in 2019, as Photonics growth of 4.4% outweighed by 22.4% drop for Wireless

After a postponement following advice to auditor KPMG from the UK Financial Reporting Council (FRC) in the midst of uncertainty in external markets due to the COVID-19 Coronavirus pandemic, epiwafer foundry and substrate maker IQE plc of Cardiff, Wales, UK has now reported its full-year 2019 financial results, which are in line with the unaudited summary financial accounts released in the trading update on 24 March.

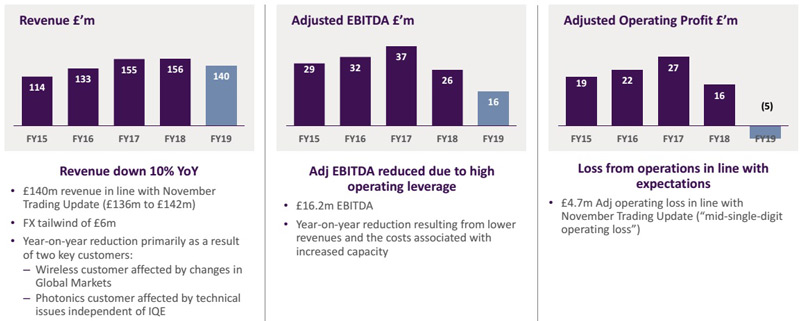

Revenue is £140m, down 10.4% on 2018’s £156.3m but in line with November’s revised guidance of £136-142m (which was reduced from June’s guidance of £140-160m).

Wireless wafer revenue fell by 22.4% from £87.9m to £68.2m (down from 56.2% to 48.7% of total wafer revenue), due to global market changes related to the geo-political landscape, including the impact of a significant decline in volume from one of IQE’s major gallium arsenide power amplifier customers, despite maintaining the previous share of that customer’s business. Gallium arsenide (GaAs) wafers comprised about 70% of Wireless revenue and gallium nitride (GaN) wafers about 30%.

Photonics wafer revenue rose by 4.4% from £66.8m to £69.8m (up from 42.7% to 49.8% of total wafer revenue), despite a significant loss of volume from an indium phosphide (InP) customer that experienced technical issues with an end customer that were outside IQE’s control. Photonics demand - especially for vertical-cavity surface-emitting laser (VCSEL) and Infrared products - continued to grow in 2019. VSCEL revenue comprised about 50% of Photonics revenue in 2019. Single-digit percentage growth was driven by demand from IQE’s existing VCSEL supply chain and initial volumes from Android supply chains. Infrared revenue comprised about 30% of Photonics revenue, with growth rates consistent with historic growth being driven primarily by defense applications.

CMOS++ segment revenue rose from £1.6m to £2.1m (up slightly from 1.1% to 1.5% of total revenue).

“IQE continues to take the right steps to protect our staff and also to maintain production at all of our global sites,” notes CEO Dr Drew Nelson. “As a supplier within the critical communications sector, IQE’s technology has a role to play in helping the world stay connected during this difficult time.”

Adjusted gross margin on wafer sales fell from 23.9% to 14.9%, reflecting under-utilization of assets in a period where revenue has declined and additional manufacturing capacity has been installed at IQE’s manufacturing sites in Newport (UK), Hsinschu (Taiwan) and Massachusetts (USA).

Adjusted selling, general and administrative (SG&A) expenses rose from £20.7m to £25.8m, reflecting an increase in non-cash amortization charges, an increase in corporate costs as the business primes itself for growth, and exchange rate movements.

Restructuring costs were £0.8m (cut from £3.3m), relating to site-specific employee-related restructuring of £0.6m and additional costs of £0.2m associated with the closure of IQE’s manufacturing facility in New Jersey. Patent dispute legal costs were £4.3m (up from £1.3m), related to a confidential legal dispute. The associated arbitration hearing ruled entirely in favour of IQE. In a related court process (in which the counterparty has stated it is considering appealing the award), the case is not yet fully resolved. Non-current asset impairments of £9.5m relate to the impairment of certain intangible, right of use and non-current financial assets.

Compared with an adjusted operating profit of £16m in 2018, 2019 yielded an adjusted operating loss of £4.7m (in line with the November trading update guidance), reflecting negative operating leverage and an increase in depreciation and amortization from targeted investments. By segment, Wireless margin fell from 18.8% to 9.7%, primarily reflecting declines in volume and associated under-utilization of manufacturing capacity. The decline in Photonics margin from 15.3% to 1.9% primarily reflects increased non-cash amortization charges and increased cost associated with IQE’s newly commissioned Mega Foundry in Newport, Wales (where volumes continue to ramp).

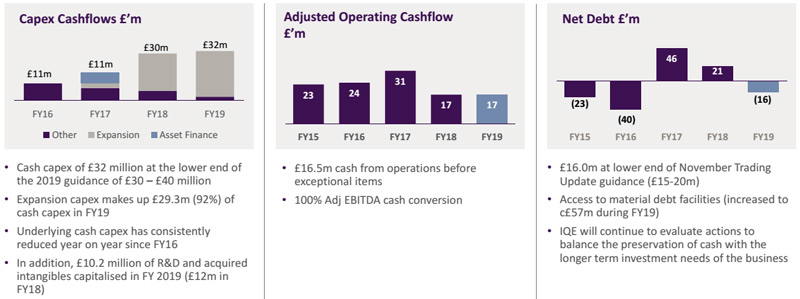

Adjusted operating cashflow was £16.5m (down from 2018’s £17m), representing 100% adjusted EBITDA to adjusted operating cash conversion.

Capital expenditure (CapEx) rose from £30.4m in 2018 to £31.9m in 2019 (as expected, towards the bottom end of the initial guidance of £30-40m), as IQE completed the infrastructure phase of investments in its new Mega Foundry in Newport (focused on the 3D sensing market), the expansion of wireless (GaAs) capacity at the Taiwan site, and consolidation of wireless GaN capacity to the Massachusetts site.

Technology-based development expenditure was £8.4m, as investment has continued in technology and intellectual property.

During 2019, cash and cash equivalents fell by £12m (albeit halved from a £24.8m decrease in 2018).

Investment in capital and technology development has been funded partially by debt. Compared with net funds of £20.8m at the end of 2018, net debt (excluding lease liabilities) was £16m at the end of 2019, near the lower end of the November trading update’s £15-20m guidance range, reflecting strong working capital management. On 24 January 2019 IQE agreed a £26.7m ($35m) three-year multi-currency revolving credit facility from HSBC Bank plc, and on 29 August it agreed a new £30m five-year Asset Finance Loan facility from HSBC Bank, increasing debt facilities to £57m (of which £25m has been drawn down).

Operational highlights in 2019 are listed as follows:

Infrastructure phase of the capacity expansion program completed:

- The Mega Foundry in Newport, South Wales entered production for 3D sensing products in May following full and comprehensive end-to-end supply-chain qualification with IQE’s lead VCSEL customer.

- Wireless capacity in Taiwan was increased to address changes in global supply chain dynamics.

- Consolidation and investment in GaN capacity in Massachusetts has been completed to capitalize on forthcoming 5G infrastructure deployments.

Next-generation product development:

- 10G and 25G full-service distributed feedback (DFB) lasers and 10G and 25G avalanche photodiodes (APDs) for high-speed datacoms and 5G fronthaul and backhaul.

- Filters (based on IQE’s patented cREO technology) and switches for 5G.

- Photonics roadmap progress including strong results for long-wavelength VCSELs for future smartphone and LiDAR deployments.

- Lasers and sensors for environmental and health monitoring.

Evolution of the board and executive management to support growth ambitions and scalability of operations:

- Phil Smith CBE, appointed as chairman.

- Carol Chesney FCA, appointed as non-executive director and chair of the Audit Committee.

- Tim Pullen ACA appointed as chief financial officer (CFO).

- Executive Management Board established and fully operational.

Increase to credit facilities to support navigation of challenging market conditions:

- £30m asset financing facility put in place, increasing total available facilities to ~£57m (£25m drawn down at 31 December 2019).

- Formal agreement in place to relax debt covenants in December 2020 and June 2021, as a precaution, to ensure continued access to debt facilities in severe downside scenarios.

Current trading and 2020 outlook

The full effects of the Coronavirus pandemic on global economic output in 2020 are still uncertain, notes IQE. The effect of an anticipated downturn on the firm’s markets is also uncertain and the increased risk to near-term performance is not currently quantifiable. “Given the unprecedented levels of uncertainty, we are unable to provide explicit guidance at this point in time. However, in line with the trading update on 24 March, trading so far in 2020 has been in line with previous expectations, and the outlook for Q2/2020 remains positive,” the firm adds.

“Q1/2020 trading was slightly higher than our internal expectations, and the outlook for Q2 remains positive at this time,” says Nelson. “IQE remains well positioned to withstand the near-term uncertainty,” he believes. “We continue to monitor developments around the pandemic, economic activity and specific market intelligence very closely and will update the market as the situation evolves.”

2020 investment guidance

Following completion of the infrastructure phase of IQE’s capacity expansion program, investment in property plant & equipment (PPE) will reduce significantly in 2020, to under £10m. Investment in R&D will continue, and the firm anticipates spending of up to £10m on capitalized intangibles in 2020.

IQE pre-announces 2019 financial performance in line with November trading update

IQE’s wireless wafer growth in 2018 outweighs VCSEL-driven drop in photonics