News: Suppliers

17 February 2023

Veeco grows revenue 11% in 2022, despite 10.5% dip in Q4 driven by smartphone-related 5G RF weakness

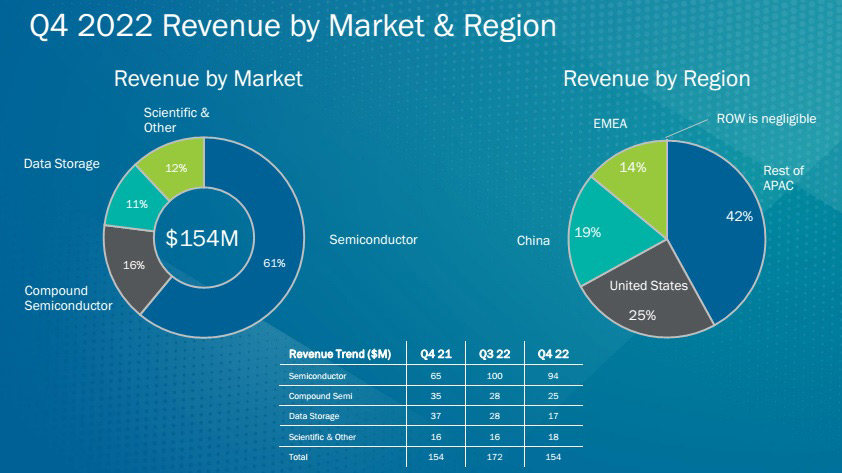

For fourth-quarter 2022, epitaxial deposition and process equipment maker Veeco Instruments Inc of Plainview, NY, USA has reported revenue of $153.8m, down 10.5% on $171. 9m last quarter but roughly level with $153m a year ago.

The Semiconductor segment (Front-End and Back-End, as well as EUV Mask Blank systems and Advanced Packaging) contributed $94m (61% of total revenue), down from $100m last quarter but up sharply on $65.4m (43% of revenue) a year ago, led by multiple laser spike anneal (LSA) systems for both leading- and trailing-edge nodes, as well as extreme ultraviolet (EUV) and advanced packaging (AP) lithography systems.

The Compound Semiconductor segment (Power Electronics, RF Filter & Device applications, and Photonics including specialty, mini- and micro-LEDs, VCSELs, Laser Diodes) contributed $25m (16% of total revenue), down on $28m last quarter and $34.7m (23% of total revenue) a year ago.

The Data Storage segment (equipment for thin-film magnetic head manufacturing) contributed $17m (11% of total revenue), down on $28m last quarter and $36.5m (24% of total revenue) a year ago.

The Scientific & Other segment (research institutions and other applications) contributed $18m (12% of total revenue), up on $16m last quarter and $16.3m (10% of total revenue) a year ago.

By region, the Asia-Pacific region (excluding China) comprised 42% of revenue (up on 26% a year ago) driven by Semiconductor system sales; the USA 25% (down on 37%); China 19% (down on 25%) mainly Semiconductor systems for trailing-edge nodes; and Europe, Middle-East & Africa (EMEA) 14% (up on 12% a year ago); with the rest of the world remaining less than 1%.

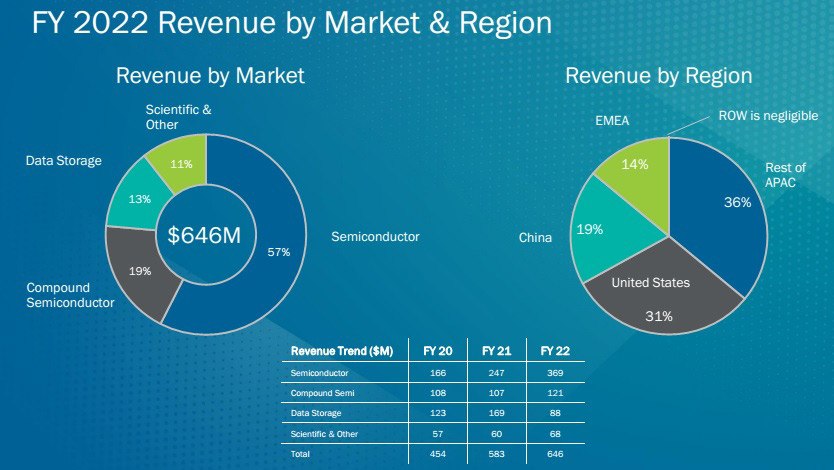

For full-year 2022, revenue grew by 11% from $583.3m in 2021 to $646.1m for 2022.

Semiconductor contributed a record $369m (57% of total revenue), up 50% on 2021’s $247.1m (43% of revenue), led by increased traction in both leading- and trailing-node laser annealing systems.

Compound Semiconductor contributed $121m (19% of total revenue), up 13% on 2021’s $107m, driven by systems for photonics applications.

Data Storage contributed just $88m (13% of total revenue), almost halving from 2021’s $168.8m (29% of total revenue), as hard-disk-drive customers slowed their pace of capacity additions for magnetic head manufacturing.

Scientific & Other (research institutions and other applications) contributed $68m (11% of total revenue), up 12% on 2021’s $60.5m.

By region, the Asia-Pacific (excluding China) comprised 36% of revenue driven by semiconductor customers; the USA 31% (down from 38%) mainly semiconductor and data-storage customers; EMEA 14% (up from 9); and China 19%; with the rest of the world remaining less than 1%.

On a non-GAAP basis, full-year gross margin has fallen slightly from 42% in 2021 to 41.9% for 2022. However, despite being down slightly on 42.4% a year ago, Q4/2022 gross margin of 42.3% was up on 42% last quarter, and exceeded guidance due to a more favorable product mix and lower manufacturing and service costs.

Operating expenses were $41.3m, up from $40m a year ago but cut from $43.9m last quarter and lower than the guidance range due to favorable selling, general & administrative (SG&A) expenses. Full-year operating expenses rose from $158.5m in 2021 to $171.2m for 2022, reflecting the R&D investments made in the Semiconductor and Compound Semiconductor segments to execute the firm’s growth strategy. However, as a percentage of revenue, OpEx has fallen from 27% to 26.5%, providing operating leverage to the company.

Quarterly net income was $21.9m ($0.38 per diluted share), down from $26m ($0.45 per diluted share) last quarter and $22.6m ($0.43 per diluted share) a year ago. Despite Q4, full-year net income has grown from $73.6m ($1.43 per diluted share) in 2021 to $89.6m ($1.57 per diluted share) for 2022.

Cash flow from operations was $33m in Q4 (almost doubling from $17m a year ago), contributing to $108m for full-year 2022 (up 60% year-on-year).

CapEx has reduced further, from $9.2m a year ago (which included $8m used for the build-out of the new facility in San Jose, CA, adding much needed Semiconductor capacity) and $6m last quarter to just $3m, bringing full-year CapEx to $25m.

During the quarter, cash and short-term investments hence rose further, by $31m, from $272m to $303m (up from $225m a year ago). As of the end of Q4, Veeco was cash debt positive.

Long-term debt was $275m, representing the carrying value of the $278m of convertible notes. Annual cash interest expense was reduced to $10m in 2022. In January 2023, $20m of the outstanding 2.7% convertible senior notes matured and were fully settled by payment and cash, reducing total convertible debt to $258m.

“We entered 2022 with supply chain challenges and strong demand. By the end of the year, the supply chain challenges persisted, while demand became more mixed, due to softness in consumer markets such as smartphones and PCs, and a weakening macro-economic environment in general,” notes CEO Bill Miller Ph.D.

“In the current weaker demand environment, customers across certain segments of our business have lowered fab utilization to address elevated levels of inventory,” says chief financial officer John Kiernan. “In some cases, they’ve taken steps to reduce both capital and operating expenses, including spare parts and service.

For first-quarter 2023, Veeco hence expects revenue to fall to $130–150m. Due to a less favorable product mix and lower volume, gross margin should fall slightly to 39–41%. With operating expenses of $42–44m, net income is expected to fall to $6–15m ($0.12–0.28 per diluted share).

However, aided by record Semiconductor orders in both Q4/2022 and full-year 2022, total orders exceeded revenue throughout 2022, yielding a positive book-to-bill ratio. Specifically, in second-half 2022, Veeco saw an accelerated booking rate for trailing-node semiconductor systems in China. For full-year 2022, China comprised about 27% of total orders, compared with just 19% of revenue (so China revenue is expected to rise as a percentage of total revenue in first-half 2023). Order backlog hence grew by $60m through 2022, from $440m to $500m.

“We enter the year cautiously optimistic given our backlog position, coupled with the mixed demand environment within which we’re operating,” says Miller. “We expect to outperform the wafer fab equipment market [forecasted to be down 20% or more in 2023] with our Semiconductor products [flat to slightly up], grow in the data-storage market and maintain profitability during the current macroeconomic challenges.”

Based on current visibility supported by order backlog, Veeco’s revenue outlook for full-year 2023 remains relatively flat on 2022 at $630–670m, with revenue in the second half exceeding that of the first half, based on the scheduled shipments of order backlog. The firm continues to target diluted earnings per share of $1.15–1.35.

“With weakness in consumer end-markets, our Wet Processing business has been experiencing a slowdown. However, the compound semiconductor end-market we’re working to penetrate with MOCVD such as GaN power electronics and micro-LED show promising signs of growth over the long-term,” says Miller. “We’re committed to continuing our R&D investments, demos and evaluations with customers and ultimately realizing growth in these markets,” he adds.

On 31 January, to “enhance our long-term growth prospects”, Veeco acquired early-stage revenue company Epiluvac AB of Lund, Sweden (whose 11 staff design and manufacture silicon carbide epitaxy systems) for $30m in cash plus up to $35m in performance-based earn-outs. The acquisition accelerates Veeco’s entry into the high-growth silicon carbide epitaxy equipment market which, driven mainly by demand for power electronics in electric vehicles (EVs), is forecasted to double from $250m in 2023 to $500m in 2027 (as the SiC device market triples from $2bn to $6bn).

“They had developed silicon carbide previously for 4-inch and 6-inch. This is a new 8-inch single-wafer silicon carbide reactor and mainframe, so it's an automated system that can run independently,” says Miller. “They have placed one system into the field, and it’s currently under installation. The second tool shipment is actually going to ship to our Somerset New Jersey lab, where we’re going to facilitate it and use that as a dedicated demonstration tool to sell equipment. So we’re planning a sales kick-off meeting here in the next week or so. With the addition of Veeco worldwide sales footprint, our service footprint and manufacturing operations, we think we have a very good chance to be competitive in this silicon carbide epi market,” he adds. “Given the timing of all this, not much revenue in 2023, but hopefully some revenue growth [incremental business] in 2024.”

“Compound Semi is setting up to be a challenging year in the near-term, driven by weakness in 5G RF-related to the smartphone weakness. In the longer-term, we do feel better about Compound Semi because these markets we’re working in to penetrate, such as power electronics and micro-LED, are growing and have enormous potential for us,” concludes Miller.

Veeco acquires silicon carbide CVD system maker Epiluvac

Veeco grows revenue 4.9% in Q2, despite supply chain constraints