News: Markets

7 December 2023

Smartphone production rebounds by 13% in Q3, after eight quarters of year-on-year declines

Fueled by reduced channel inventories and spikes in seasonal demand, global smartphone production rose by 13% quarter-to-quarter to about 308 million units in third-quarter 2023, according to market research firm TrendForce. Although this figure has yet to reach pre-pandemic levels, it is up 6.4% year-on-year, ending an eight-quarter streak of annual declines.

Looking ahead to fourth-quarter 2023, e-commerce promotions and the year-end shopping boom — coupled with the customary end-of-year surge in production by smartphone brands — are likely to stimulate a further 5–10% quarter-on-quarter increase in production. The projected downturn in annual smartphone production for 2023 is expected to be limited to less than 3%, to about 1.16 billion units.

Huawei’s market return puts pressure on Apple’s market share in China for next year

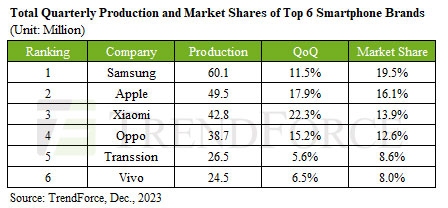

Leveraging its presence in the flagship smartphone market, Samsung continues to lead the market (with market share of 19.5%) after recording an 11.5% increase in production to 60.1 million units in Q3. Despite Samsung’s extensive global reach, the firm’s conservative planning in light of global economic headwinds has narrowed its annual production lead over Apple to just 5 million units.

Apple, riding the wave of its latest flagship releases, saw its production climb by 17.9% to about 49.5 million units in Q3. However, the initial low yield rates of the CMOS image sensor (CIS) in the iPhone 15/15 Plus series adversely affected Apple’s Q3 performance, resulting in a 1.5% year-on-year market share decline to 16.1%, with annual production expected to align with 2022 levels.

Huawei’s re-entry with its flagship phones has made a significant impact on the high-end smartphone market in China, with Apple being the primary target. As Huawei aims to expand its high-end flagship series in 2024 with a focus on the Chinese domestic market, the company is set to directly challenge Apple. This strategy, coupled with prevailing geopolitical factors, positions Huawei as a formidable competitor and is expected to significantly impact Apple’s production performance in the upcoming year.

Transsion outperforms Vivo in Q3 to clinch fifth place

Following the completion of channel inventory adjustments, Xiaomi (including Xiaomi, Redmi and POCO) has shifted to a more assertive stance in both device production and component stockpiling as the year draws to a close. Xiaomi’s Q3 production jumped by 22.3% to about 42.8 million units — bolstered by the resurgence of the Indian market — solidifying its status as the world’s third-largest producer (with 13.9% market share).

Oppo (including Oppo, Realme and OnePlus) experienced a 15.2% increase in its output to 38.7 million units in Q3. Fueled by rising sales in markets like India and South America, this growth is expected to maintain its momentum into the fourth quarter.

Transsion (including TECNO, Infinix and itel) continued its robust performance from Q2 into Q3, with its production output rising by 5.6% quarter-to-quarter to 26.5 million units. This surge enabled Transsion to overtake Vivo again and secure the fifth place globally (with 8.6% market share). The brand has been thriving in emerging markets and steadily growing its market share since the second quarter. With the potential for an annual growth rate exceeding 40%, Transsion remains in close competition with Vivo for global rankings.

Vivo (including Vivo and iQoo) saw its production grow by 6.5% to 24.5 million units in Q3, placing it in the sixth spot (with 8% market share). In response to the global economic downturn, the firm adopted a more conservative production plan in first-half 2023. Even as the market in China — one of its primary regions — began to improve in the latter half of the year, Vivo maintained its strategy aimed at ensuring steady profits.

Smartphone production falls 6.6% year-on-year to 272 million in Q2; first-half 2023 down 13.3%