News: Markets

28 January 2022

Apple iPhone tops smartphone market in Q4/2021, but Samsung remains top for full year

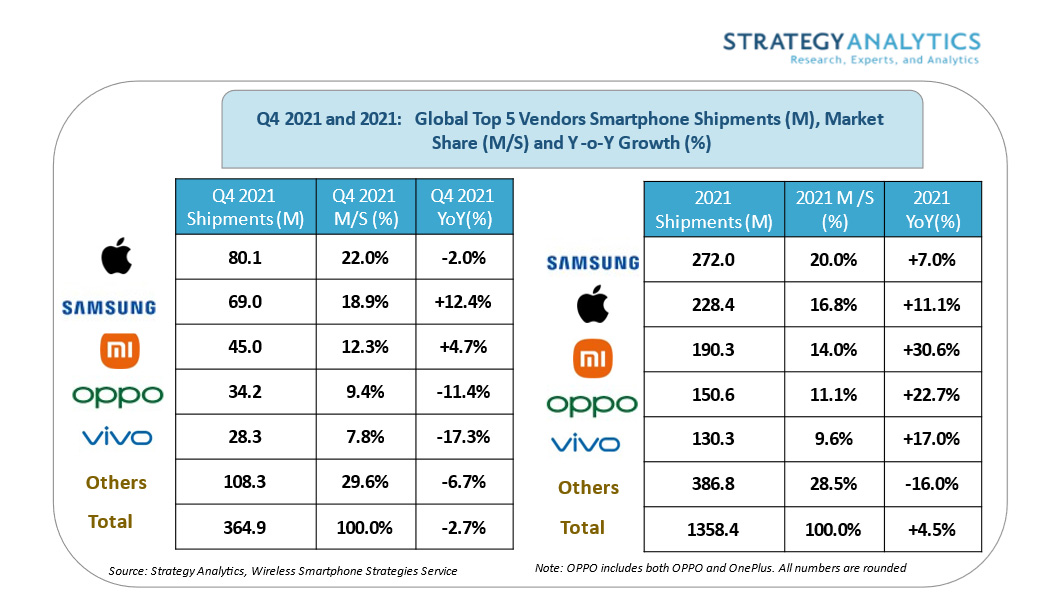

Global smartphone shipments fell by 2.7% year-on-year to 365 million units in fourth-quarter 2021, according to market research firm Strategy Analytics. “Factory constraints and component shortages continued to restrict smartphone supply in the final quarter of last year,” notes senior director Linda Sui.

Despite this, full-year smartphone shipments still rose by 4.5% year-on-year to 1.36 billion units in 2021, recovering from a sharp Covid-led decline of -8% year-on-year during 2020.

Picture: Global smartphone shipments and market share in Q4/2021 and full-year 2021.

Apple iPhone topped the global smartphone market with a 22% share in Q4/2021, shipping 80 million units. “Demand was strong for the new iPhone 13 series in China and other markets,” notes Woody Oh, director at Strategy Analytics.

However, for full-year 2021, Apple remained in second place (with 16.8% market share), as Samsung maintained first place (with 20% market share).

Samsung shipped 69 million smartphones, up 12.4% year-on-year, for 18.9% market share in Q4/2021. “Samsung had a good quarter, led by its innovative Flip and Fold 5G models. Samsung grew faster than all its major rivals,” he adds. Samsung ramped up volumes in North and South America amid the withdrawal of LG, but the competition in Asia remained fierce.

Xiaomi shipped 45 million smartphones and took third place with 12.3% global market share in Q4/2021, up slightly from 11% a year ago. “Xiaomi benefitted from the withdrawal of Huawei and LG and expanded its retail footprint into all major regions last year,” says senior analyst Yiwen Wu.

OPPO (OnePlus) held fourth spot and captured 9.4% global market share in Q4/2021. Vivo stayed fifth with 7.8% market share in Q4/2021. However, OPPO (OnePlus) and Vivo both lost ground, as 5G competition from Honor and other smartphone competitors intensified sharply at home in China.”

“Global competition among other major smartphone brands, beyond the top-five, was fierce during Q4/2021,” notes Neil Mawston, executive director at Strategy Analytics. “Honor, Lenovo-Motorola, Realme and Transsion all outperformed the overall market and posted double-digit growth rates. Honor continued to soar in China. Lenovo-Motorola gained share from LG in the Americas. Realme had a very strong quarter in India, China and elsewhere. Transsion held firm across the Africa region,” he adds.

“We forecast global smartphone shipments to grow a mild +3% year-on-year in full-year 2022,” says senior director Linda Sui. “This year will be a tale of two halves. Component shortages, price inflation and Covid uncertainty will continue to weigh on the smartphone market during the first half of 2022, before the situation eases in the second half due to Covid vaccines, interest rate rises by central banks, and less supply disruption at factories.”

Smartphone revenues to rebound by 13% in 2021 after 5% drop in 2020