News: Markets

20 April 2021

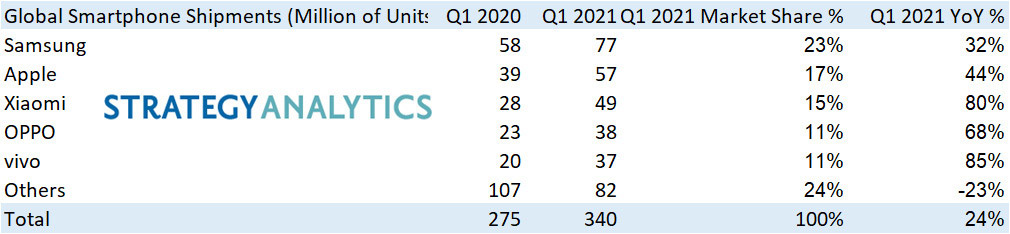

Smartphone shipments surge by 24% YoY to 340 million in Q1

Global smartphone shipments were 340 million units in first-quarter 2021, up +24% on 275 million a year ago (the highest growth since 2015), reports market research firm Strategy Analytics. The smartphone market rebound was driven by healthy demand from consumers with aging devices and a phenomenal 5G push from Chinese vendors, it notes.

Graphic: Global Smartphone shipments (millions of units) and market share (%) for top five vendors. N.B. All Q1/2021 smartphone shipment numbers are preliminary and subject to minor adjustments.

“The China smartphone market had a sensational quarter, driven by 5G product success across multiple price tiers,” comments senior director Linda Sui. China smartphone shipments were up +35% year-on-year, reaching 94 million units in Q1/2021. Globally, the top five vendors combined took a 76% market share, up from 71% a year ago. “Chip shortages and supply-side constraints did not have a significant impact in Q1 among the top five brands but was and will be a concern for smaller vendors over the next few quarters in our view,” she adds.

Samsung remains the largest vendor, shipping 77 million smartphones globally in Q1, up 32% year-on-year from 58 million units in Q1/2020. “Samsung’s newly launched, more affordable A series 4G and 5G phones and the earlier launched Galaxy S21 series combined drove solid performance in the quarter,” notes executive director Neil Mawston. Apple shipped 57 million units iPhones worldwide (up 44% from 39 million a year ago), capturing second place with a 17% volume market share. “The strong momentum behind the 5G iPhone 12 series continued across multiple markets,” he adds.

Xiaomi held third place in terms of volume of smartphones shipped for the second quarter in a row, shipping 49 million globally (up 80% on 28 million a year ago) and taking a 15% market share in Q1 (up from 10% a year ago). “The vendor maintained strong momentum in both India and China, and the expansion in Europe, Latin America and Africa region also started to bear fruit,” comments senior analyst Yiwen Wu.

OPPO (not including Realme and OnePlus) won 11% market share and remained the fourth largest smartphone vendor in Q1. It was followed by vivo, which grew an impressive 85% year-on-year.

Smartphone revenues to rebound by 13% in 2021 after 5% drop in 2020