- News

23 September 2019

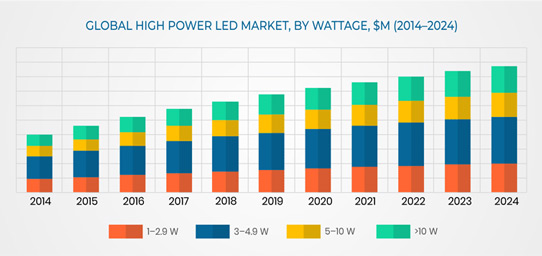

High-power LED market growing at 5.3% CAGR to $17,581.5m in 2024

The high-power light-emitting diode (LED) market was $12,647.2m in 2018 and will rise at a compound annual growth rate (CAGR) of 5.3% from 2019 to $17,581.5m in 2024, according to a report by P&S Intelligence. The major factors stimulating growth include rising adoption of energy-efficient lighting solutions and increasing government support for the adoption of LED lights globally.

Based on wattage, the high-power LED market is classified into 1–2.9W, 3–4.9W, 5–10W and >10W. Among these, the 5–10W category is expected to see the fastest growth due to the rising deployment of 5–10W high-power LEDs in general lighting applications, such as outdoor lighting and entertainment lighting.

By application, the high-power LED market is segmented into automotive, general lighting, backlighting, signs & signals, and others (including camera flash lighting, infrared emitters and ultraviolet LEDs). Of these, the automotive category is projected to register a CAGR of 5.4% due to increasing demand for high-power LEDs in both exterior and interior applications, such as fog lights, position lights, headlights, ambient lighting and dashboard lights. In addition, demand for high-power LEDs in backlighting application (including gaming, channel letter lighting and portable appliances) has risen significantly and is projected to grow steadily.

Geographically, the Asia-Pacific (APAC) region is expected to account for a substantial share of the high power LED market, due mainly to the growing adoption of high-power LEDs in general lighting, mainly in China and India. Also, several smart-city development projects are in the pipeline in these countries, which are expected to generate huge demand for high-power LED lights. For example, China introduced a national development project in 2012 to build smart cities with modern technology. Further, the Chinese government aims to nurture 100 new smart cities to lead their urban planning and development by 2020.

Rising adoption of energy-efficient products, along with increasing government focus toward energy saving, is fueling the demand for energy-efficient lighting sources, predominantly high-power LEDs, which is likely to bolster the growth of the high-power LED market. High-power LEDs are particularly advantageous in general lighting and automotive applications as they work efficiently for long operating hours at low maintenance cost. Due to these advantages, local authorities of countries, such as the USA, India, China, and Australia, have commenced projects to replace their conventional lighting lamps used in outdoor lighting with LEDs. For example, in 2014, according to the US Department of Energy, the city of Los Angeles had completed a citywide street lighting replacement program and installed over 215,000 LED streetlights (saving about $9m in annual energy costs).

Furthermore, in 2016, the Institute of Public Works Engineering Australasia (IPWEA) and the Australian government together showcased a strategic roadmap to promote LED lights to increase energy efficiency under the Street Lighting and Smart Controls Programme. Hence, an increasing number of government initiatives to reduce energy consumptions is expected to bolster high-power LED market growth in the future.

The high-power LED market is highly competitive and fragmented, with the presence of a large number of global and regional players. Some of the key players include Cree Inc, Osram Licht AG, Nichia Corp, Samsung Electronics Co Ltd, Seoul Semiconductor Co Ltd, Everlight Electronics Co Ltd, Lumileds Holding B.V., MLS Co Ltd, LG Innotek Co Ltd, Broadcom Inc, and Epistar Corp. These companies are adopting product launches, as a key strategy, to maintain their stronghold in the market, says the report.

For example, in May 2018, Samsung Electronics introduced LED components for horticultural lighting. Its new horticulture LED lineup features a newly developed red LED package, in addition to key existing Samsung white LED package and module families to include horticultural lighting specifications.

Most recently, in May 2019, Lumileds introduced two new additions to its LUXEON chip-on-board (COB) LED family. The LUXEON COB Core Range and the LUXEON COB with CrispWhite Technology can deliver a minimum of color rendering index (CRI) of 95 for applications such as indoor lighting and retail lighting.

www.psmarketresearch.com/market-analysis/high-power-led-market