- News

18 July 2014

Silicon photonics market to grow at CAGR of 38% from $25m in 2013 to $700m in 2024

Beyond all of the hype and tumult, market drivers and technological developments are converging to ensure a bright future for silicon photonics, according to the ‘Silicon Photonics 2014’ report from Yole Développement. Indeed, although the silicon photonics market has just kicked off, volume production is already close.

Big data is getting bigger by the second, and transporting it with existing technologies will push the limits of power consumption, density and weight. The report’s authors are convinced that photons will replace electrons, and that silicon photonics will be the mid-term platform to assist this transition.

Silicon photonics offers the advantages of silicon technology: low cost, higher integration, more embedded functionalities, and higher interconnect density. It also provides two other key advantages:

- low power consumption (particularly compared with copper-based solutions, which are expensive and require high electrical consumption);

- reliability (especially important for data centers, where a typical rack server’s lifespan is two years before replacement).

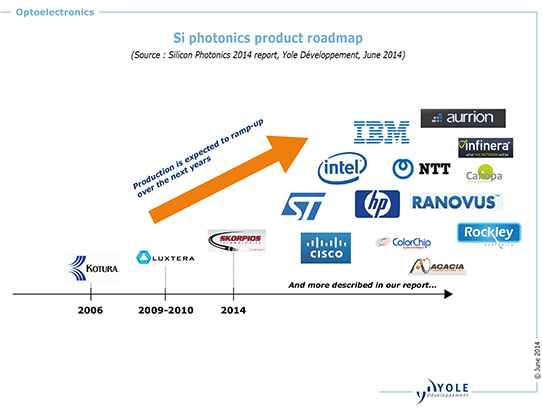

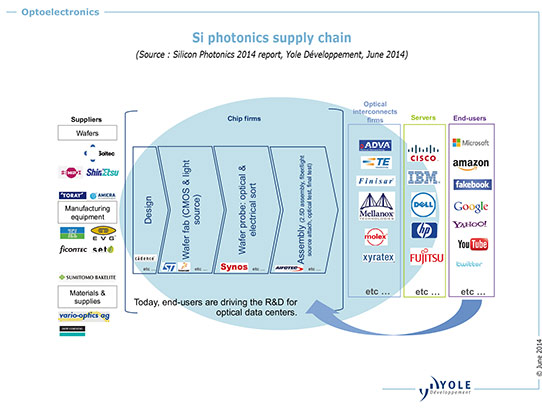

Back in 2006, variable optical attenuators (VOAs) were the market’s first silicon photonics products. Today, there are still just a few silicon photonics products on the market - i.e. VOAs, active optical cables (AOCs) and transceivers from Luxtera, Kotura/Mellanox and Cisco/Lightwire - but big companies (e.g. Intel, HP and IBM) are close to realizing silicon photonics products. Big OEMs such as Facebook, Google and Amazon are developing their own optical data-center technology in partnership with chip firms (such as Facebook with Intel).

“In the short-term, silicon photonics will be the platform solution for future high-power, high-bandwidth data centers,” says Dr Eric Mounier, senior technology & market analyst, MEMS Devices & Technologies, at Yole. Silicon photonics chips will be deployed in high-speed signal transmission systems that greatly exceed the capabilities of copper cabling, i.e. for data centers and high-performance computing (HPC). In addition, as silicon photonics evolves and chips become more sophisticated, Yole expects the technology to be used more often in processing tasks such as interconnecting multiple cores within processor chips to boost access to shared cache and busses. Yole also analyzed the prospects of silicon photonics being used for telecom, consumer, medical and biosensors applications, compared with competing technologies.

Acquisitions and consolidation ongoing

The report estimates that almost $1bn has been spent in the past three years on acquisitions of silicon photonics companies. This is not surprisingly, says Yole, considering that silicon photonics is seen as the optical technology that will be leveraged for future bottlenecks for interconnects in data centers and HPCs in the short term.

The main motivations for such acquisitions are:

- to handle increasing traffic in data centers; and

- to strengthen a company’s portfolio in 40GB and 100GB optical engines.

![]()

Acquisitions are generally made by module/system makers as a means of enlarging their technologies portfolio, since this is a faster, cheaper route than R&D investment, notes Yole. “We also see big players such as Intel taking both approaches (acquisitions and R&D), while others have decided not to invest in silicon photonics since they think future designs will be accessible via foundry services,” says the report. “In fact, many IC foundries have started proposing silicon photonics wafer foundry services, so this could create additional acquisition opportunities in the near future.”

Technical choices and new opportunities

Silicon photonics is a field that mixes optics, CMOS, MEMS and 3D stacking technologies. Yole notes that over the past several years it has become clear that some technical choices will be better than others for successful commercial development:

- The light source is a big integration challenge. A silicon laser is probably years away from realization, so the different approaches are likely to be either attached laser (i.e. Luxtera) or indium phosphide (InP) wafer-to-wafer/die-to-wafer bonding, followed by post-processing (i.e. Intel or Leti).

- There has also been a shift from monolithic integration for electronics/photonics to hybrid integration, since critical dimensions are very different. Currently, the favored approach seems to be two-chip hybrid integration (the Cu-pillar from STMicroelectronics, for example), since the critical dimensions of semiconductors and photonics are likely to be at least one order of magnitude different.

- The fiber choice: multi-mode versus single mode is also on the table.

“Silicon photonics is a business opportunity for different player types: OSATS (outsourced assembly & test houses), MEMS firms, semiconductors companies etc, because it involves different challenges for packaging, optical alignment and electronics integration,” explains Claire Troadec, Technology & Market Analyst, Semiconductor Manufacturing, at Yole. “The need for very diverse technologies creates a need for different packaging/micro-machining/manufacturing approaches,” she adds.

Turning point expected in 2018

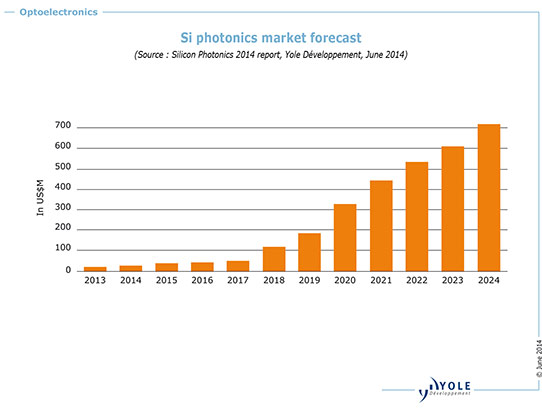

In the report, Yole provides a forecast of the silicon photonics market for four different applications: HPC, future-generation optical data centers, telecoms and others (including sensors, medical and consumer).

The firm looked at the following modules/devices: transceivers (for AOCs) and embedded optics (from mid-board optics to interposers to intra-chip interconnects). It is estimated that the silicon photonics device market will increase at a compound annual growth rate (CAGR) of 38% from about $25m in 2013 to more than $700m in 2024, triggered in 2018 by emerging optical data centers from big Internet companies (Google, Facebook, etc).

Non-datacom/telecom sectors will have only a small portion of market value, since these applications are still far from market maturity, notes Yole. “However, we are at a turning point where the market is increasing again, and Intel - which is very active in this field - could contribute to a quick ramp-up of silicon photonics,” the market research firm concludes.

www.i-micronews.com/reports/Silicon-Photonics-2014-report/8/445