News: Markets

2 June 2022

Smartphone production volume falls 12.8% to 310 million in Q1 due to amplified off-season effect

The multiplicative effect of the traditional off-season further weakened smartphone production performance in first-quarter 2022, with global output only reaching 310 million units, down 12.8% quarter-on-quarter, according to market research firm TrendForce. Compared with the same period last year, the strategic planning adopted by smartphone brands in response to Huawei’s market share collapse is quite different, with annual decline in production as high as 10.1%.

Looking to Q2/2022, in the face of rising inflation intensified by the Russian-Ukrainian war and the direct impact of China’s lockdowns, the momentum of consumption continues to weaken. According to TrendForce's current observations, global smartphone production volume in Q2/2022 is forecast at about 309 million units, which is roughly on par with Q1, but the lingering possibility of a subsequent downgrade this quarter cannot be ruled out.

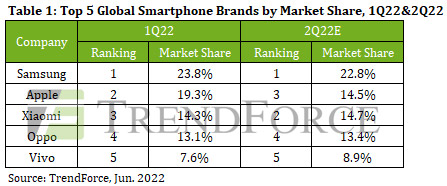

Global top-five brands accounts for 78% of market in Q1; Samsung regains top spot

Benefiting from an easing of 4G low-end processor chip supply and the launch of its new Galaxy S22, Samsung's production volume in Q1/2022 increased to 73.8 million units, ranking first in the world. Looking at developments in Q2, since Samsung’s central production sites are located in Vietnam and India and its market share in China is merely 1%, it is unruffled by the turmoil in the supply chain and domestic demand stemming from China’s dynamic zero-COVID policy. However, the impact of the Russian-Ukrainian war festers in Q2. Samsung was originally the leading smartphone brand in Russia but in March it joined sanctions against the country and completely suspended product shipments. Coupled with rising inflation, Samsun’s production performance in Q2 will be dampened and is expected to decline compared with Q1.

Apple’s iPhone 13 series continued to sell well, and the new SE3 helped Apple’s production volume reach 60 million units in Q1, achieving excellence performance compared with the same period last year, with an annual growth of rate 11.1%. This was due mainly to cannibalizing Huawei’s former high-end model orders while making up for losses incurred from the suspension of mobile phone sales in Russia in response to the Russia-Ukraine war. The Chinese lockdowns adversely affected the operation performance of foundries and the supply chain. Fortunately, during Q2 Apple was in a transition period between new and old models and, since Q2 normally posts the lowest production performance in the year, any collateral impact was relatively limited.

The iPhone 14 series to be launched by Apple in second-half 2022 will feature four new models. Most notably and unlike prior offerings, only the latest processors are employed in the Pro series. In addition to taking into account terminal pricing strategy, this can also highlight differences in market positioning. As rising inflation changes consumer behavior, this type of product positioning is expected to attract more buyers.

The Chinese smartphone market had begun showing obvious signs of weakness since second-half 2021, leading to more cautious quarterly production planning from Xiaomi (including Redmi, POCO, Black Shark), OPPO (including Realme, OnePlus), and Vivo (including iQoo), with Q1/2022 production volume coming in at 44.5 million, 40.5 million and 23.5 million units, respectively. Due to the high overlap between positioning and product planning of these three brands in the sales market, factors such as delayed delivery of 4G low-end processor chips at the beginning of the quarter and sluggish sales in the Chinese market will directly affect production performance. OPPO and Vivo exhibited a more significant quarterly decline due to their large market share in China. At the same time, the rapid rise of Honor, coupled with its strategy of focusing on the Chinese market as its primary sales foundation, will also threaten Xiaomi, OPPO and Vivo, which likewise focus on the domestic demand market in China. TrendForce has also observed the rapid rise of Honor’s market share and forecasts its market share in China will surpass that of Xiaomi and close in on OPPO and Vivo in 2022.

5G mobile phones grow steadily, with market share reaching 50% in 2022

According to TrendForce, looking at performance in 2022 as a whole, first-half 2022 was mainly influenced by China’s lockdowns and the Russian-Ukrainian war, and second-half 2022 will be influenced by the inflation crisis, with annual production volume coming in at about 1.333 billion units. However, if China continues its dynamic zero-COVID policy into Q3/2022, combined with the one-two punch of inflation and energy shortages, the global smartphone market may face further downward revision.

Despite the continuous adjustment of production targets, 5G mobile phones continue growing steadily. Since being released in 2019, 5G mobile phones have benefited from the Chinese government’s diligent promotion of commercial transformation. In 2021, 5G’s global market share reached 38%. The subsequent growth momentum of 5G mobile phones will be driven by markets outside of China. With the steady increase in global 5G base-station coverage, the global market share of 5G mobile phones is forecast to reach 50% in 2022, or about 661 million units, of which Apple possesses the lion’s share, says TrendForce.

Q4 smartphone production sees 9.5% quarter-on-quarter growth, driven by 66% growth for Apple