- News

10 April 2014

Next investment cycle already begun in LED front-end equipment

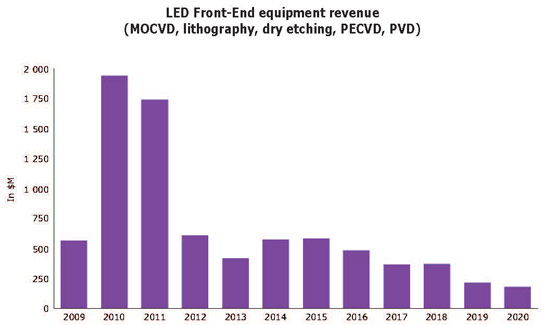

Driven by the fanfare over (and over-estimation of) the LCD display market, the LED front-end equipment market experienced an unprecedented investment cycle in 2010-2011, driven mostly by metal-organic chemical vapor deposition (MOCVD) reactor shipments to new Chinese entrants who benefited from generous subsidies of the Chinese central and local governments in a bid to stimulate domestic chip production. Now, following a 18-24 month digestion period, the market is slowly recovering and will experience another investment cycle in 2014-2016, driven by demand for general lighting applications, according to the report ‘LED Frond-End Equipment Market’ from Yole Développement. However, this second cycle will be limited in value due to: improvements in equipment throughput and yields; increased competition; and potential consolidation in the industry.

Indeed, LED makers initially relied on old semiconductor systems designed for other applications. However, now that the industry has reached a critical size, several LED-dedicated systems (which take into account the specificities of LED manufacturing) have been commercialized, notes Yole.

As a result, the equipment market will peak at nearly $580m in 2015, with MOCVD reactors representing more than 80% of business. The bulk of these are still being shipped to Chinese manufacturers or Taiwanese players transitioning to 4”-diameter wafers. Lithography, plasma etching, plasma-enhanced chemical vapor deposition (PECVD) and physical vapor deposition (PVD) equipment will follow a similar trend, Yole forecasts.

Different markets with different competitive landscapes

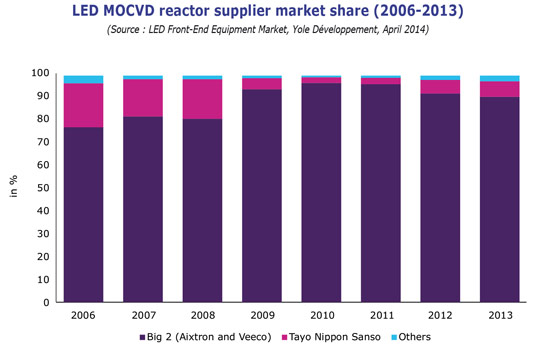

The LED epitaxy equipment market (MOCVD reactors) is very concentrated, under the control of the big three (Aixtron, Veeco and Taiyo Nippon Sanso) who represented nearly 97% of the market in 2013.

Comparatively, the lithography, plasma etching, PECVD and PVD equipment markets are much more fragmented, with several players battling to enlarge their market share. For example, the top three suppliers of LED lithography equipment represented nearly 70% of the market in 2013, with the remaining 30% divided between more than 10 competitors.

Yole says that this situation is due to the specificities of the different LED front-end manufacturing process steps:

- LED epitaxy is quite specific and requires dedicated tools supplied by companies that have developed strong expertise.

- Other LED front-end manufacturing processes can use older or refurbished semiconductor systems designed for other applications. Also, with the growth of the LED industry, suppliers of LED-dedicated systems have also appeared. This has further fragmented these markets, now both traditional semiconductor equipment suppliers and new LED-dedicated equipment suppliers compete.

Increased competition in MOCVD, but no impact on market structure

The LED epitaxy equipment market has always been of central interest to equipment manufacturers due to the high average selling price (ASP), strong profitability, and large market volume (compared with other equipment sectors).

Since 2010, following the explosion of the LED TV market, more than 20 players (mostly from Asia) have tried to enter the MOCVD reactor market, but without real success: in 2013, these new suppliers represented only 3% of the market share (up only +2% compared with 2010).

This situation has arisen for two main reasons:

- New entrants have missed the first two LED growth cycles (small-display and large-display applications) that allowed leaders to build their expertise and their networks (sales offices, training centeres etc). Even the big players in semiconductor equipment manufacturing, such as Applied Materials, did not achieve access in these markets.

- Revenue collected during the 2010-2011 investment cycle (totaling more than $2bn for MOCVD reactors, with more than 90% going to Aixtron and Veeco) allowed those firms to slash ASPs and initiate a price war to lever further market-entry barriers.

The current LED front-end industry is driven largely by cost reduction (as technological evolutions are reaching their saturation point), notes Yole. The main strategy developed by a new MOCVD reactor supplier is to focus on reducing cost of ownership (CoO), for example through a new heating system, new gas flow design, increased automation, etc. However, even if this is the best strategy to adopt, Yole does not expect new entrants to make a big gain in market share in future, as the finances and expertise of the big two suppliers far surpasses any of their competitors.

Yole concludes that, in the short term, only two types of suppliers (outside of the big three) will survive:

- suppliers that develop collaborations with some big LED makers;

- Chinese suppliers that are able to scrape together bits and pieces of the huge local market.

LED front‐end equipment market to see turbulent investment cycles

LEDs MOCVD PECVD PVD Lithography Yole

www.i-micronews.com/reports/LED-Front-End-Equipment-Market/14/429